Demystifying Income Tax Act's Section 43B(h): How Deductions for Payments to MSEs Work [FAQs]

Welcome to a deep dive into Section 43B(h) of the Income-tax Act, where we unravel the complexities surrounding deductions for payments to Micro and Small Enterprises (MSEs). Did you know that MSEs play a crucial role in the Indian economy, accounting for over 30% of the country’s GDP and employing millions of people? Despite their significant contribution, issues like delayed payments often challenge their financial stability.

Section 43B(h) comes into play as a means to support MSEs by allowing deductions for certain payments made to them. Understanding this provision is essential, especially given that the late payment culture in India affects nearly 60% of MSEs, leading to cash flow problems and hindering their growth potential.

In this blog, we aim to simplify the complexities of Section 43B(h) and provide clarity on how these deductions work. Through an FAQ format, we’ll address common questions and shed light on the practical aspects of availing deductions for payments to MSEs, helping you navigate this aspect of income tax law with confidence.

What is Section 43B(h) of the Income Tax Act?

Section 43B(h) of the Income Tax Act pertains to deductions for payments made to Micro and Small Enterprises (MSEs). It allows eligible businesses to claim deductions for certain payments made to MSEs, even if these payments are not made within the financial year but before the due date of filing the income tax return.

Who qualifies as Micro and Small Enterprises (MSEs) under Section 43B(h)?

As per the Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006, enterprises engaged in manufacturing or production of goods or providing services and having investment in plant and machinery or equipment up to specified thresholds are classified as Micro or Small Enterprises. The thresholds vary based on the type of enterprise (manufacturing or service) and are periodically revised by the government.

What payments are eligible for deductions under Section 43B(h)?

Payments made by eligible businesses to MSEs for goods supplied or services rendered are eligible for deductions under Section 43B(h). These payments can include purchase of goods, services availed, lease payments, interest on loans, etc., provided they meet the criteria specified under the Income Tax Act.

What are the steps to claim deductions under Section 43B(h)?

To claim deductions under Section 43B(h), businesses need to ensure the following steps:

- Maintain records: Keep detailed records of payments made to MSEs, including invoices, receipts, agreements, and other relevant documents.

- Timely payment: Make payments to MSEs within the stipulated time frames to qualify for deductions.

- Obtain certification: Obtain a certificate from the MSE confirming the amount due and payment made.

- File income tax return: Declare the payments made to MSEs and claim deductions under Section 43B(h) while filing the income tax return before the due date.

What are the benefits of claiming deductions under Section 43B(h)?

Claiming deductions under Section 43B(h) provides several benefits for businesses, including:

– Reduction in taxable income: Deductions result in a lower taxable income, leading to reduced tax liability.

– Support for MSEs: Encourages timely payments to MSEs, fostering better business relationships and supporting the growth of small enterprises.

– Compliance with tax laws: Ensures compliance with the Income Tax Act and avails legitimate tax-saving opportunities within the legal framework.

Does Section 43B(h) apply to capital goods?

Section 43B(h) doesn’t directly apply to capital goods. Unlike Section 37(1), which distinguishes between capital and revenue expenditure, Section 43B looks at payments that are otherwise eligible for deductions under the Income Tax Act.

This means that if you owe money to a micro or small enterprise (MSE) for buying capital goods and you can claim a 100% deduction under Sections 30 to 36, then Section 43B(h) applies.

However, if you can’t claim a full deduction for the capital expenditure, then not paying the MSE supplier on time won’t lead to a disallowance of depreciation on those capital goods. That’s because depreciation isn’t a payment eligible for deductions under Section 43B. In simple terms, Section 43B(h) only affects payments for which you can claim deductions, and depreciation isn’t one of them.

What are the criteria for ascertaining Micro and Small units?

The criteria used to determine Micro and Small units are based on a combined limit of turnover and investment in plant, machinery, and equipment, as outlined below:

Type of Unit | Investment | Machinery and Equipment |

Micro Enterprises | Not more than Rs. 1 crore | Not more than Rs. 5 crore |

Small Enterprises | Not more than Rs. 10 crore | Not more than Rs. 50 crore |

Whether the traders are covered for the purpose of this section?

This section mainly applies to Micro, Small, and Medium Enterprises (MSMEs) engaged in manufacturing or providing services. Traders, who are primarily involved in retail or wholesale activities, were allowed MSME registration primarily for Priority Sector Lending (PSL) benefits, but not for benefits related to delayed payments under the MSMED Act, 2006.

Therefore, traders cannot be considered as suppliers under this section if their UDYAM certificate identifies them as traders. While there’s some debate on whether traders can claim benefits under this provision, businesses should include traders in their understanding to avoid potential tax issues in the future.

How can an assessee identify that his supplier is a micro or small enterprise?

An assessee can identify whether their supplier is a Micro or Small Enterprise (MSE) through several means:

- UDYAM Registration: MSEs are required to register under the UDYAM (Udyog Aadhaar Memorandum) portal, which is a government initiative for MSME registration. The UDYAM certificate issued to the supplier will specify whether they are classified as a Micro, Small, or Medium Enterprise based on their turnover and investment in plant, machinery, and equipment.

- Supplier Information: Assessees can directly inquire with their suppliers about their MSME status. Suppliers should be transparent about their classification and provide relevant documentation or certificates to verify their status as an MSE.

- Government Databases: Assessees can also verify the MSE status of their suppliers through government databases such as the MSME Data Bank, where details of registered MSEs are available for public access. This allows assessees to cross-check information provided by suppliers.

- Procurement Policies: Many organizations have specific procurement policies or guidelines that prioritize sourcing from MSEs. Assessees can review their own procurement policies to ensure compliance with government regulations and promote procurement from MSEs.

- Financial Statements: MSEs often have distinctive financial characteristics, such as lower turnover, limited investment in assets, and simplified accounting practices. Assessees can analyze the financial statements of their suppliers to identify signs of MSE classification.

- Legal Documents: Contracts, agreements, invoices, and other legal documents between the assessee and the supplier may mention the supplier’s MSME status or reference applicable government regulations regarding MSE classification.

By utilizing these methods, assessees can effectively identify whether their supplier qualifies as a Micro or Small Enterprise, ensuring compliance with relevant regulations and leveraging benefits associated with sourcing from MSEs.

What are the consequences of delayed payments to Micro, Small, and Medium Enterprises (MSME) vendors?

Source: India Financial Consultancy

Delayed payments to MSME vendors can have significant consequences under the Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006. Section 15 of the Act specifically addresses the issue of delayed payments and outlines the following consequences:

Interest Penalty: According to Section 16 of the MSMED Act, if a buyer fails to make payment to an MSME vendor within the agreed-upon period (typically 45 days from the date of acceptance of goods or services), the buyer is liable to pay compound interest to the vendor at three times the prevailing bank rate. This interest penalty is calculated from the due date until the actual date of payment.

Statutory Obligation: Timely payment to MSME vendors is a statutory obligation under the MSMED Act. Failure to adhere to payment timelines specified in the Act can lead to legal repercussions, including penalties and legal proceedings initiated by the MSME vendor.

Dispute Resolution: Section 18 of the Act provides a mechanism for resolving disputes related to delayed payments between MSME vendors and buyers. MSME vendors can file applications with the Micro and Small Enterprises Facilitation Council (MSEFC) for initiating conciliation and settlement procedures.

Recovery Mechanism: In case of non-payment or delayed payment beyond 45 days, MSME vendors have the right to initiate recovery proceedings under the Act. They can approach the MSEFC for recovering the principal amount along with interest and applicable penalties.

Credit Rating Impact: Persistent delays or defaults in payments to MSME vendors can adversely impact the credit rating and reputation of the buyer. This may affect the buyer’s ability to secure credit facilities or engage in future business transactions with other vendors.

It’s important for buyers to honor payment commitments to MSME vendors within the stipulated timelines to avoid legal repercussions, financial penalties, and damage to business relationships. Adherence to payment terms not only supports the growth and sustainability of MSMEs but also promotes a healthy and compliant business environment.

What does Section 43B(h) of the Income Tax Act pertain to?

Section 43B(h) of the Income Tax Act focuses on deductions for payments made to Micro and Small Enterprises (MSEs). It allows eligible businesses to claim deductions for certain payments made to MSEs, even if these payments are not made within the financial year but before the due date of filing the income tax return.

What types of payments are eligible for deductions under Section 43B(h)?

Payments made by eligible businesses to MSEs for goods supplied or services rendered are eligible for deductions under Section 43B(h). These payments can include purchase of goods, services availed, lease payments, interest on loans, etc., provided they meet the criteria specified under the Income Tax Act.

Are there any time limits for claiming deductions under Section 43B(h)?

What are the consequences of non-compliance with Section 43B(h)?

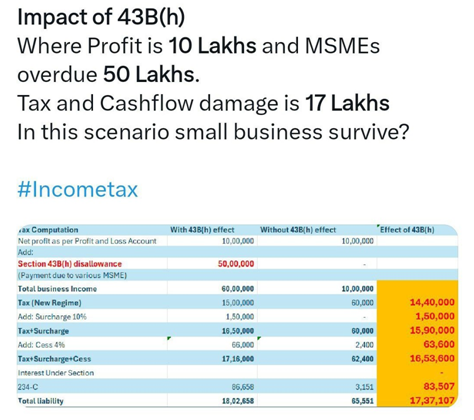

Non-compliance with Section 43B(h) can lead to disallowance of deductions claimed for payments to MSEs. This can result in higher taxable income for the business, leading to increased tax liability, penalties, and potential legal implications.

How can businesses ensure compliance with Section 43B(h)?

To ensure compliance with Section 43B(h), businesses should:

– Maintain detailed records of payments made to MSEs, including invoices, receipts, agreements, and other relevant documents.

– Make payments to MSEs before the due date of filing the income tax return for the relevant financial year.

– Obtain a certificate from the MSE confirming the amount due and payment made.

– Accurately report payments made to MSEs in the income tax return and claim deductions under Section 43B(h) accordingly.

Section details: Section 43B(h) is a crucial provision under the Income Tax Act that supports and encourages timely payments to Micro and Small Enterprises (MSEs). It aims to foster a conducive business environment for MSEs by allowing businesses to claim deductions for payments made to MSEs, thereby promoting financial stability and growth in the MSE sector.

This section is particularly relevant for businesses that engage with MSEs for procurement of goods, services, or other transactions. By understanding and complying with the provisions of Section 43B(h), businesses can not only avail tax benefits but also contribute to the sustainable development of MSEs and the overall economy.

Does Section 43B(h) apply to suppliers who are not registered under Udyam (MSME registration)?

Whether Section 43B(h) applies to unregistered suppliers depends on their classification as micro or small enterprises (MSEs). Udyam registration for MSMEs is optional, indicated by the term “may” in the notification, with no mandatory requirement to upload documents.

Section 43B(h) specifically references Section 15 of the MSMED Act, which requires Udyam Registration for the supplier to be classified as a micro or small enterprise. Without Udyam Registration, Section 15 of the MSMED Act may not be invoked for disallowance under Section 43B of the IT Act. Therefore, the applicability of Section 43B(h) to non-registered suppliers depends on their compliance with Udyam Registration requirements for MSE classification.

How can I verify the authenticity of the Udyam Number provided by my supplier, especially if it's printed on the invoice or presented differently?

You can authenticate the Udyam Registration Number provided by your supplier by following these steps:

- Visit the Udyam Portal at https://udyamregistration.gov.in/udyam_verify.aspx

- Utilize the newly enabled “Verify Udyam Registration Number” feature on the portal.

- Enter the Udyam Registration Number provided by your supplier into the verification tool.

- The portal will display the status and details of the Udyam Registration, confirming its authenticity.

Can I access the Udyam Registration details of a supplier by searching for their name or PAN on the Udyam portal?

No, you cannot obtain the Udyam Registration details of a supplier by searching for their name or PAN on the Udyam portal. Instead, you can check the status and details of Udyam Registration only if you have the supplier’s Udyam Registration Number. Inputting this specific number into the portal’s verification tool allows you to verify the authenticity of the registration.

Is the disallowance rule applicable to taxpayers using the cash system of accounting?

The disallowance rule does not apply to taxpayers who use the cash system of accounting. According to Section 43B of the IT Act, expenses can only be allowed on a payment basis, irrespective of whether the taxpayer follows a mercantile system of accounting. The cash accounting method records revenues and expenses only when cash is received or paid out, respectively. Therefore, if a taxpayer already uses the cash basis of accounting, the disallowance rule will not impact them as they already record expenses based on payment.

What distinguishes the recently incorporated clause (h) from other clauses in Section 43B and what does it offer?

Section 43B typically addresses outstanding sums paid after the financial year-end, whereas the new clause (h) focuses specifically on payments to micro or small enterprises beyond the time limit set by the Micro Small Medium Enterprises Development Act.

Unlike other clauses in Section 43B that allow deductions for year-end outstanding amounts if paid by the due date of filing the income tax return, clause (h) only permits deductions if payments are made within the timeframe specified in Section 15 of the Micro Small Medium Enterprises Development Act.

Conclusive Thoughts

In conclusion, understanding the intricacies of Section 43B(h) and its implications for payments to Micro and Small Enterprises (MSEs) is crucial for businesses to navigate tax compliance effectively. The provision highlights the importance of timely payments to MSEs, offering deductions to incentivize such transactions.

However, it’s essential for taxpayers to adhere to the specified timelines and maintain accurate records to avoid disallowances and legal consequences. Utilizing tools like Udyam registration verification can further enhance transparency and authenticity in dealings with MSE suppliers. Overall, Section 43B(h) plays a significant role in promoting financial stability and growth within the MSE sector while ensuring compliance with tax regulations.

Featured blog

Facing an Income Tax Notice? Here’s What You Need to Know and How to Respond

In recent times, the Income Tax Department has significantly ramped up its issuance of notices to taxpayers across India. These notices are being sent out for a multitude of reasons, ranging from discrepancies in income disclosure to cases of tax evasion spanning previous years.

Startup India Explained: Eligibility, Tax Exemptions, and Incentives

A Startup India initiative taken up by the Indian government is what is normally referred to as a policy by the national government in support of small business enterprises and is owned by the Indian PM Mr. Narendra Modi with the main aim of expanding the country's economy.

Demystifying Income Tax Act’s Section 43B(h): How Deductions for Payments to MSEs Work [FAQs]

Welcome to a deep dive into Section 43B(h) of the Income-tax Act, where we unravel the complexities surrounding deductions for payments to Micro and Small Enterprises (MSEs). Did you know that MSEs play a crucial role in the Indian economy,

Send Message

Contact Information

- 606, 6th Floor, The Spire, Near Ayodhya Chowk, 150 Feet Ring Rd, Rajkot, Gujarat 360006.

- +91 70460 48421

- [email protected]