Startup India Explained: Eligibility, Tax Exemptions, and Incentives

A Startup India initiative taken up by the Indian government is what is normally referred to as a policy by the national government in support of small business enterprises and is owned by the Indian PM Mr. Narendra Modi with the main aim of expanding the country’s economy. Startup India, which was inaugurated in 2016, is a scheme designed to encourage innovations, entrepreneurship, and unemployment rates through a reintegrating startup ecosystem.

Leveraging a variety of policies, programs and incentives, the government became the engine behind which dreams of starting up a business came true and boosted entrepreneurship across the country.

The government has rolled out these initiatives under the Startup India program including these measures to support startups, such as – simplification of regulatory processes, promotion of ease of doing business and provision of tax breaks and exemptions.

Narendra Modi’s being at the helm as the prime minister, with his active engagement combined with his unflinching zeal towards fostering entrepreneurship and innovations has been the dynamic driving force in branding India as the destination of choice for budding entrepreneurs and promising ideas by the worldwide audience. Let us penetrate further to understand the eligibility guidelines, tax holidays and investment incentives given under Startup India and see how it has helped the startup revolution in India.

What is the Startup India Scheme?

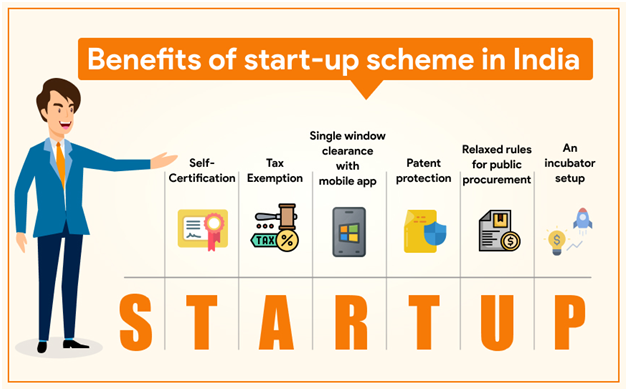

Source: Credence Corporate Solution

The Startup India scheme which was started on January 16, 2016 by the government of India, is a significant scheme that helps and supports the start-ups in India through bank infusions. The scheme was formally inaugurated by the veteran finance minister Arun Jaitley.

DPIIT, as an oversight body, prompts the State Government to bar the existence of certain regulatory jurisdictions, such as License Raj, land permits, FDI approvals, and environmental clearances. The scheme operates on three main pillars:

- Enhancing fund diversity as well as creating incentives for companies from all nonogram countries to engage in biotechnology as well as supporting startups across the country.

- To stimulate collaboration between industrial enterprises and academia and to offer incubation support.

- Enabling startups to simplify their day-to-day operations by offering step-by-step guides to aid startup authorities in starting and managing their businesses.

Registration for Startup India

To successfully register your business under the Startup India scheme, follow these key steps:

- Begin by incorporating your business as either a Private Limited Company, Limited Liability Partnership, or Partnership Firm, ensuring you have obtained the necessary certificates like PAN and complied with all legal requirements.

- Log in to the official Startup India website and complete the registration form by providing essential business details and uploading the required documents.

- Essential documents include a letter of recommendation, Incorporation/Registration Certificate, and a brief business description.

- Startups must be recognized by the Department of Industrial Policy and Promotion (DIPP) and certified by the Inter-Ministerial Board (IMB) to be eligible for income tax and IPR benefits.

- Upon successful registration and document verification, you will receive a recognition number and a certificate of recognition for your startup.

It’s also beneficial for IAS aspirants to familiarize themselves with the Stand-Up India scheme, which offers slightly different opportunities than Startup India.

Eligibility Criteria for Startup Recognition

- Company Type: The startup must be incorporated as a private limited company, registered as a Limited Liability Partnership, or established as a partnership firm.

- Annual Turnover: The turnover should not exceed 100 Crores rupees in any of the previous financial years.

- Company Age: An entity qualifies as a startup until 10 years from the date of its incorporation.

- Innovation and Scalability: The startup should focus on creating or improving existing services, products, and processes. It should demonstrate potential for generating employment and wealth creation.

- Original Entity: A startup cannot be an entity formed through the splitting up or reconstruction of an existing business.

Explore Benefits of Startup India

Following the introduction of the Startup India scheme, the government launched several initiatives aimed at supporting Indian entrepreneurs. One such program is the I-MADE program, focusing on assisting entrepreneurs in building 1 million mobile app startups.

Additionally, the government introduced the Pradhan Mantri Mudra Yojana, offering financial support to entrepreneurs from low socioeconomic backgrounds through low-interest rate loans. The key benefits of Startup India include:

- Reduction of patent registration fees.

- Improvement of the Bankruptcy Code to provide a 90-day exit window.

- Freedom from complex inspections and capital gains tax exemption for the first 3 years of operation.

- Establishment of an innovation hub under the Atal Innovation Mission.

- Targeting 5 lakh schools and involving 10 lakh children in innovation-related programs.

- Development of new schemes offering Intellectual Property Rights (IPR) protection to startup firms.

- Encouragement of entrepreneurship nationwide.

- Promotion of India as a startup hub globally.

Tax exemptions allowed to Eligible Startups under the Startup India Program

In this section, we will delve into the tax exemptions and benefits offered to eligible startups under the Startup India program. These incentives play a crucial role in fostering innovation, encouraging entrepreneurship, and boosting economic growth.

We’ll explore the various tax exemptions in detail, including income tax, capital gains tax, service tax, customs duty, and more. Understanding these exemptions is vital for startups looking to leverage the benefits of the Startup India initiative and navigate the regulatory landscape effectively.

Income Tax Exemption

– Eligible startups can avail of income tax exemption for a period of three consecutive assessment years out of their first ten years from the date of incorporation.

– To qualify, startups must be recognized by the Department of Industrial Policy and Promotion (DIPP) and certified by the Inter-Ministerial Board (IMB).

Capital Gains Tax Exemption

– Startups are exempt from paying capital gains tax on the sale of residential property, provided the gains are invested in equity shares of eligible startups.

Investment Intermediaries Tax Exemption

– Angel investors funding eligible startups are exempt from the ‘Angel Tax,’ a tax on investment above fair market value.

Employee Stock Options (ESOP) Taxation

– Taxation on ESOPs issued by eligible startups has been deferred to the earlier of five years from the date of issue or the date of sale of such shares.

Customs Duty Exemption

– Startups can avail of customs duty exemption on imported goods for research and development purposes.

Minimum Alternate Tax (MAT) Credit Carryforward

– MAT paid by eligible startups can be carried forward and set off against future taxable income.

These tax exemptions and benefits are designed to promote entrepreneurship, innovation, and growth within the startup ecosystem in India. Eligible startups should fulfill the criteria set by the government and comply with the necessary regulations to avail of these tax benefits.

Frequently Asked Questions

What is the eligibility criteria for startups to avail tax exemptions under Startup India?

Startups must be recognized by the Department of Industrial Policy and Promotion (DIPP) and certified by the Inter-Ministerial Board (IMB) to qualify for tax exemptions. They should also meet the definition of a startup as per the Startup India scheme guidelines.

Can startups avail income tax exemptions for more than three consecutive assessment years?

No, startups can avail income tax exemption for a maximum of three consecutive assessment years out of their first ten years from the date of incorporation.

Are all services provided by startups exempt from service tax under Startup India?

No, only specified services are exempt from service tax for eligible startups. It's essential to check the list of exempted services provided by the government.

How does the capital gains tax exemption work for startups selling residential property?

Startups are exempt from paying capital gains tax on the sale of residential property if the gains are invested in equity shares of eligible startups within specified timelines.

Are there any conditions for availing customs duty exemption on imported goods for research and development purposes?

Yes, startups must use the imported goods exclusively for research and development purposes to avail customs duty exemption. They should also comply with customs regulations and documentation requirements.

Featured blog

Facing an Income Tax Notice? Here’s What You Need to Know and How to Respond

In recent times, the Income Tax Department has significantly ramped up its issuance of notices to taxpayers across India. These notices are being sent out for a multitude of reasons, ranging from discrepancies in income disclosure to cases of tax evasion spanning previous years.

Startup India Explained: Eligibility, Tax Exemptions, and Incentives

A Startup India initiative taken up by the Indian government is what is normally referred to as a policy by the national government in support of small business enterprises and is owned by the Indian PM Mr. Narendra Modi with the main aim of expanding the country's economy.

Demystifying Income Tax Act’s Section 43B(h): How Deductions for Payments to MSEs Work [FAQs]

Welcome to a deep dive into Section 43B(h) of the Income-tax Act, where we unravel the complexities surrounding deductions for payments to Micro and Small Enterprises (MSEs). Did you know that MSEs play a crucial role in the Indian economy,

Send Message

Contact Information

- 606, 6th Floor, The Spire, Near Ayodhya Chowk, 150 Feet Ring Rd, Rajkot, Gujarat 360006.

- +91 70460 48421

- [email protected]